If you are busy doomscrolling social media or, heaven forbid, actually watching the national newscasts, you may think the sky is falling. Real estate is the backbone of the US economy, and interest rates have stayed steady in the 6s. Has this affected home sales? In Savannah, the biggest effect has been on timing, not on actual sales or appreciation.

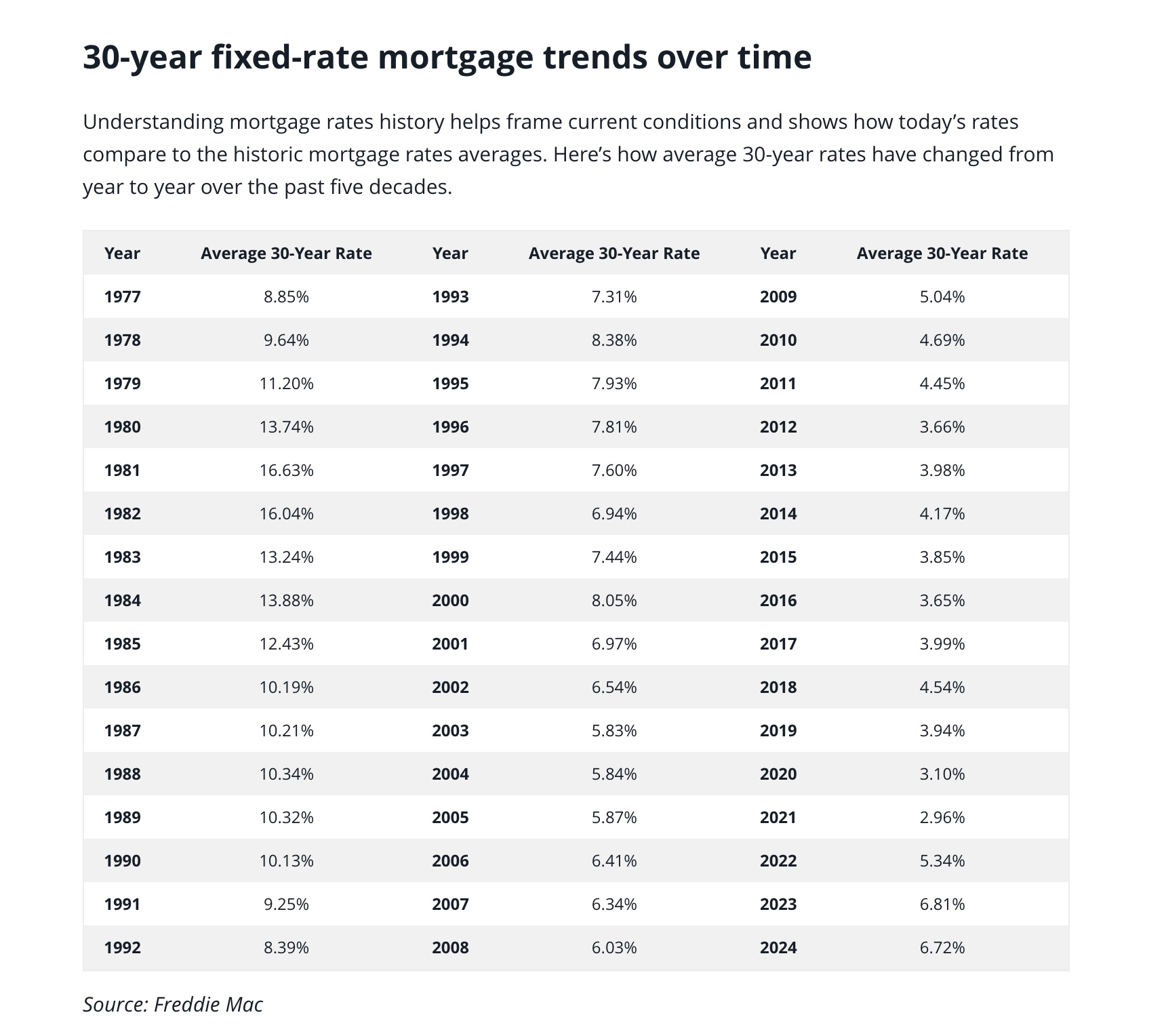

The days of 2 & 3% interest rates are long gone. People say they are “trapped in their house because of the interest rate.” True, those rates were an artificial point in time that many took great advantage of, yet, are you really trapped? Every situation is different. You may have had huge appreciation that would counter-balance moving with a higher interest rate. How long do you plan to be in your next home? An ARM (adjustable rate mortgage) may be the solution. Many have rates that lock for 5 or 7 years. If you tend to move often, this is a great option. If you are waiting for rates to lower before you buy, you may be waiting a long time. In 1977, the average mortgage interest rate was 8.85%. In 1978, if someone said they would not buy until interest rates were the same, they would have waited until 1992! In many areas, the appreciation of homes in that same period was 20 -30%, while the Waiter was still renting.

A friend recently asked me if home values are dropping. Though not in the market, she loves to follow homes for sale and refers to her Zillow feed as “house porn.” You may also notice New Price or Price Reduced sign riders above the For Sale signs in your neighborhood. This is not a sign of overall home depreciation. This is an indicator of a shifting market. Meaning, sellers tend to reach for a higher price. In an accelerating market, like the one we saw in 2021, this works. As the market has normalized, it is chasing a market that no longer exists. In a shifting market, homes that sell quickly are listed at or below the last sales in a neighborhood. Not 10% above. Your home, which is not for sale, has not lost value. We are still seeing a steady appreciation of 3-5% per year, not 20%. A quick example would be if you purchased a home last year for $500,000 and put it up for sale today, you will not get $600,000 unless you have done major improvements. You may get $525,000 or even $540,000 if you got a deal when you purchased. Asking $600,000 will cause the home to either sit on the market or not appraise when it does get an offer. Has this home lost value? No. It is worth more than you paid for it.

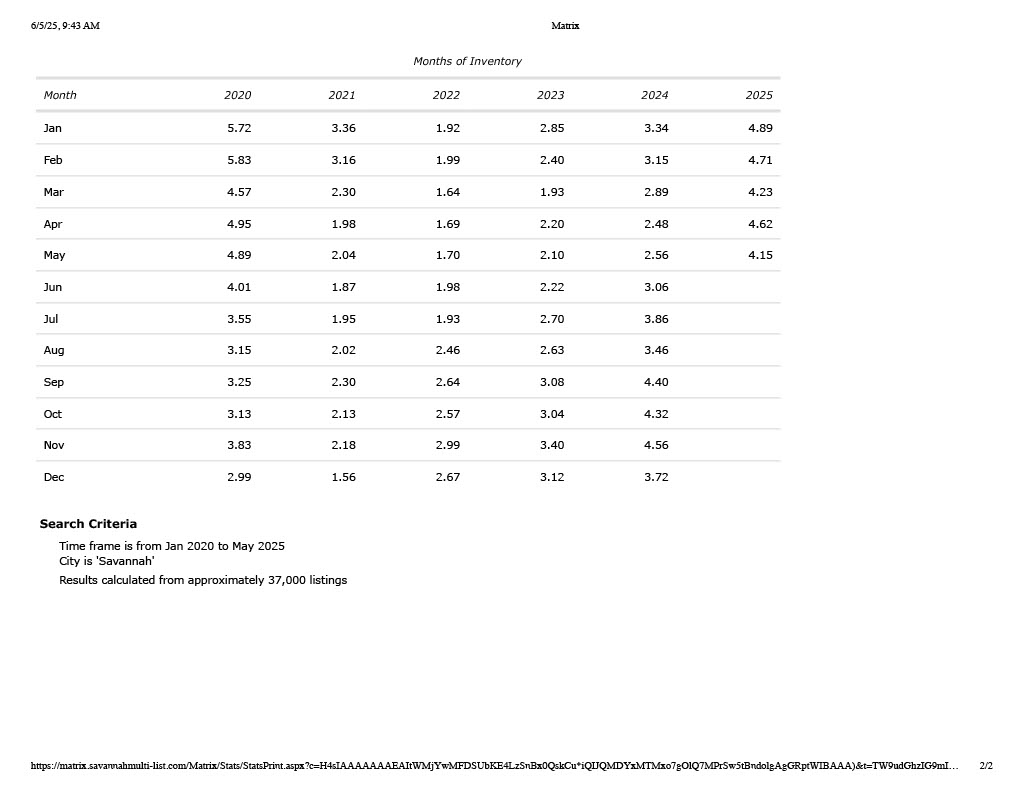

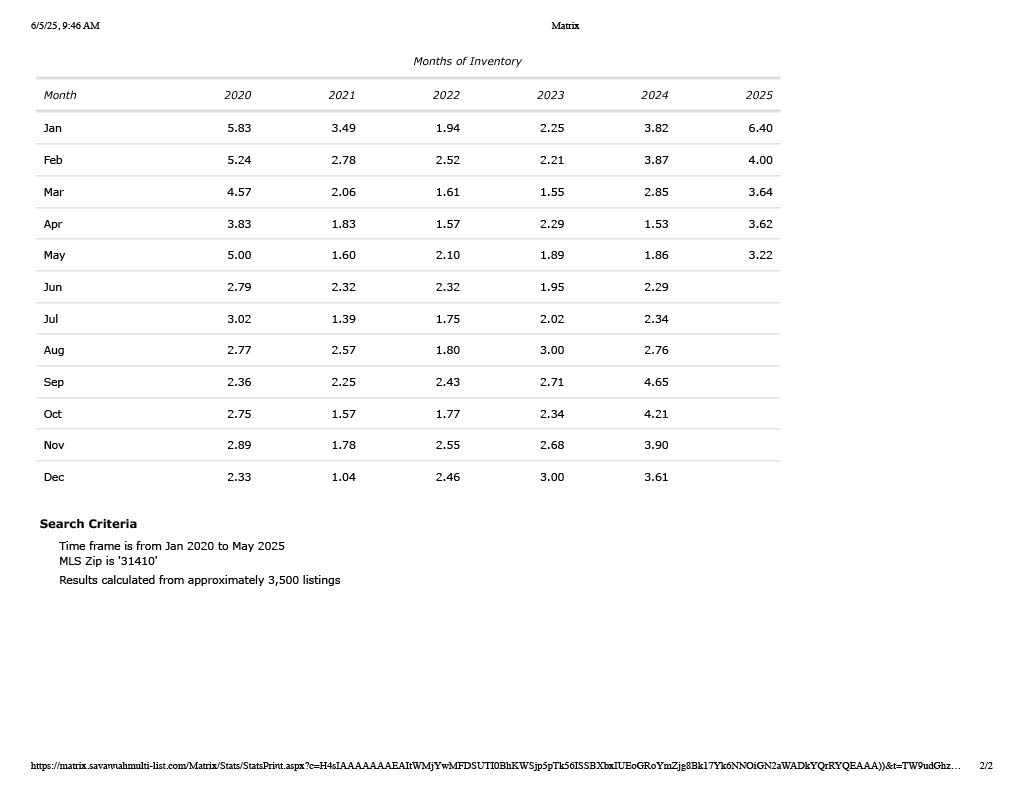

Where is the Seller’s advantage? There are still more Buyers in the market than homes for sale. In last week's blog post, I broke down the absorption rate. (See Is Tybee Island “On Sale”) Greater Savannah is still averaging 4 months of inventory. The Islands, zip code 31410, which includes Wilmington and Whitemarsh Islands, is even lower, coming in at 3.22 for May 2025. In comparison, Tybee Island is 11.62. Tybee is a Buyers’ Market.

If you are looking to sell a home, it is more important than ever to have a professional help you. I have been doing this for 23 years. If you want honesty, give me a call. Other agents may tell you what you want to hear, then badger you to lower the price when your home doesn’t sell. The longer the home sits, the general public starts to make unfounded assumptions, like there is something wrong with it. The only thing wrong may be the price. It is taking longer to sell homes. In June of 2022, the average was 32 days. Meaning some homes sold in 1 day and some in 3 months. Now we are double that for homes priced correctly.

If you are looking to purchase a home, this is the best time we have seen in 5 years. The gap is closing, and some areas have a neutral or, like Tybee, a Buyer’s Market. Even if you are saving money for a future purchase, talking to me now will position you in the best spot. It is all about positioning. Find me on the socials, email me at Michelle@LiveInSavannah.com or be OG and call me. 912-200-8338. I’d love to talk to you about Savannah.